Timeseries#

Links: notebook, html, python, slides, GitHub

Ce notebook présente quelques étapes simples pour une série temporelle. La plupart utilise le module statsmodels.tsa.

from jyquickhelper import add_notebook_menu

add_notebook_menu()

%matplotlib inline

Données#

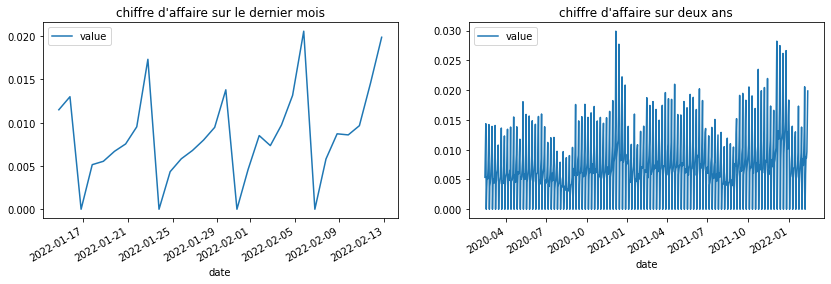

Les données sont artificielles mais simulent ce que pourraient être le chiffre d’affaires d’un magasin de quartier, des samedi très forts, une semaine morne, un Noël chargé, un été plat.

from ensae_teaching_cs.data import generate_sells

import pandas

df = pandas.DataFrame(generate_sells())

df.head()

| date | value | |

|---|---|---|

| 0 | 2020-02-13 18:54:23.461489 | 0.005357 |

| 1 | 2020-02-14 18:54:23.461489 | 0.009562 |

| 2 | 2020-02-15 18:54:23.461489 | 0.014353 |

| 3 | 2020-02-16 18:54:23.461489 | 0.000000 |

| 4 | 2020-02-17 18:54:23.461489 | 0.003475 |

Premiers graphiques#

La série a deux saisonnalités, hebdomadaire, mensuelle.

import matplotlib.pyplot as plt

fig, ax = plt.subplots(1, 2, figsize=(14, 4))

df.iloc[-30:].set_index('date').plot(ax=ax[0])

df.set_index('date').plot(ax=ax[1])

ax[0].set_title("chiffre d'affaire sur le dernier mois")

ax[1].set_title("chiffre d'affaire sur deux ans");

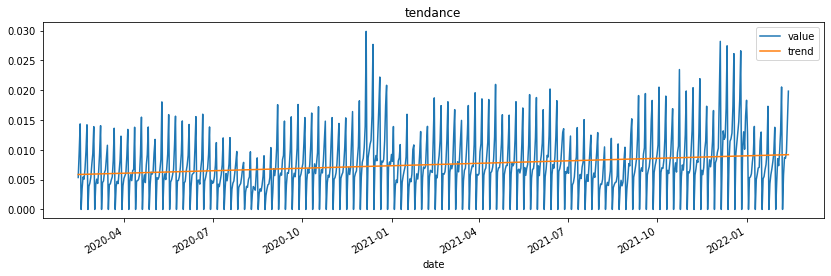

Elle a une vague tendance, on peut calculer un tendance à l’ordre 1, 2, …

from statsmodels.tsa.tsatools import detrend

notrend = detrend(df.value, order=1)

df["notrend"] = notrend

df["trend"] = df['value'] - notrend

ax = df.plot(x="date", y=["value", "trend"], figsize=(14,4))

ax.set_title('tendance');

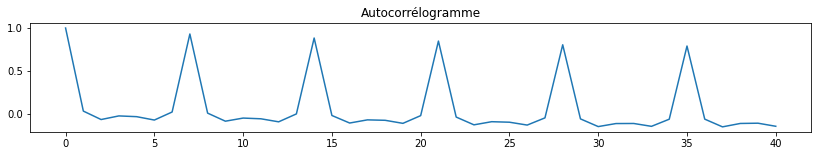

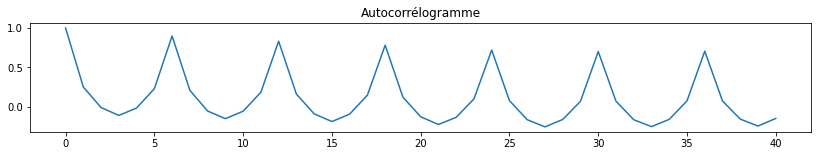

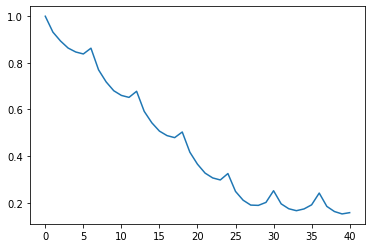

Autocorrélations…

from statsmodels.tsa.stattools import acf

cor = acf(df.value)

cor

C:Python395_x64libsite-packagesstatsmodelstsabasetsa_model.py:7: FutureWarning: pandas.Int64Index is deprecated and will be removed from pandas in a future version. Use pandas.Index with the appropriate dtype instead. from pandas import (to_datetime, Int64Index, DatetimeIndex, Period, C:Python395_x64libsite-packagesstatsmodelstsabasetsa_model.py:7: FutureWarning: pandas.Float64Index is deprecated and will be removed from pandas in a future version. Use pandas.Index with the appropriate dtype instead. from pandas import (to_datetime, Int64Index, DatetimeIndex, Period, C:Python395_x64libsite-packagesstatsmodelstsastattools.py:657: FutureWarning: The default number of lags is changing from 40 tomin(int(10 * np.log10(nobs)), nobs - 1) after 0.12is released. Set the number of lags to an integer to silence this warning. warnings.warn( C:Python395_x64libsite-packagesstatsmodelstsastattools.py:667: FutureWarning: fft=True will become the default after the release of the 0.12 release of statsmodels. To suppress this warning, explicitly set fft=False. warnings.warn(

array([ 1. , 0.03577944, -0.06235687, -0.02029818, -0.02898255,

-0.06825401, 0.0250769 , 0.93062748, 0.0120951 , -0.08157127,

-0.04537123, -0.05365516, -0.08887674, 0.00289459, 0.88395645,

-0.01531838, -0.1028712 , -0.06616495, -0.07120575, -0.10659382,

-0.01690792, 0.84848022, -0.0335295 , -0.12382299, -0.08744705,

-0.09339856, -0.12657065, -0.04305763, 0.80550906, -0.05483815,

-0.14409999, -0.10895806, -0.10812254, -0.14125818, -0.05846692,

0.79099037, -0.05773434, -0.14731918, -0.10789494, -0.10483253,

-0.14058412])

fig, ax = plt.subplots(1, 1, figsize=(14,2))

ax.plot(cor)

ax.set_title("Autocorrélogramme");

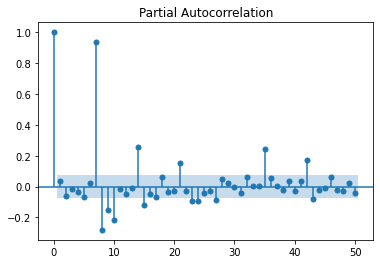

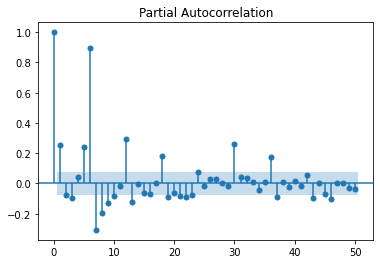

La première saisonalité apparaît, 7, 14, 21… Les autocorrélations partielles confirment cela, plutôt 7 jours.

from statsmodels.tsa.stattools import pacf

from statsmodels.graphics.tsaplots import plot_pacf

plot_pacf(df.value, lags=50);

Comme il n’y a rien le dimanche, il vaut mieux les enlever. Garder des zéros nous priverait de modèles multiplicatifs.

df["weekday"] = df.date.dt.weekday

df.head()

| date | value | notrend | trend | weekday | |

|---|---|---|---|---|---|

| 0 | 2020-02-13 18:54:23.461489 | 0.005357 | -0.000507 | 0.005864 | 3 |

| 1 | 2020-02-14 18:54:23.461489 | 0.009562 | 0.003694 | 0.005868 | 4 |

| 2 | 2020-02-15 18:54:23.461489 | 0.014353 | 0.008481 | 0.005873 | 5 |

| 3 | 2020-02-16 18:54:23.461489 | 0.000000 | -0.005877 | 0.005877 | 6 |

| 4 | 2020-02-17 18:54:23.461489 | 0.003475 | -0.002407 | 0.005882 | 0 |

df_nosunday = df[df.weekday != 6]

df_nosunday.head(n=10)

| date | value | notrend | trend | weekday | |

|---|---|---|---|---|---|

| 0 | 2020-02-13 18:54:23.461489 | 0.005357 | -0.000507 | 0.005864 | 3 |

| 1 | 2020-02-14 18:54:23.461489 | 0.009562 | 0.003694 | 0.005868 | 4 |

| 2 | 2020-02-15 18:54:23.461489 | 0.014353 | 0.008481 | 0.005873 | 5 |

| 4 | 2020-02-17 18:54:23.461489 | 0.003475 | -0.002407 | 0.005882 | 0 |

| 5 | 2020-02-18 18:54:23.461489 | 0.005454 | -0.000432 | 0.005886 | 1 |

| 6 | 2020-02-19 18:54:23.461489 | 0.005075 | -0.000816 | 0.005891 | 2 |

| 7 | 2020-02-20 18:54:23.461489 | 0.006801 | 0.000906 | 0.005896 | 3 |

| 8 | 2020-02-21 18:54:23.461489 | 0.009831 | 0.003931 | 0.005900 | 4 |

| 9 | 2020-02-22 18:54:23.461489 | 0.014204 | 0.008299 | 0.005905 | 5 |

| 11 | 2020-02-24 18:54:23.461489 | 0.003875 | -0.002039 | 0.005914 | 0 |

fig, ax = plt.subplots(1, 1, figsize=(14,2))

cor = acf(df_nosunday.value)

ax.plot(cor)

ax.set_title("Autocorrélogramme");

C:Python395_x64libsite-packagesstatsmodelstsastattools.py:657: FutureWarning: The default number of lags is changing from 40 tomin(int(10 * np.log10(nobs)), nobs - 1) after 0.12is released. Set the number of lags to an integer to silence this warning. warnings.warn( C:Python395_x64libsite-packagesstatsmodelstsastattools.py:667: FutureWarning: fft=True will become the default after the release of the 0.12 release of statsmodels. To suppress this warning, explicitly set fft=False. warnings.warn(

plot_pacf(df_nosunday.value, lags=50);

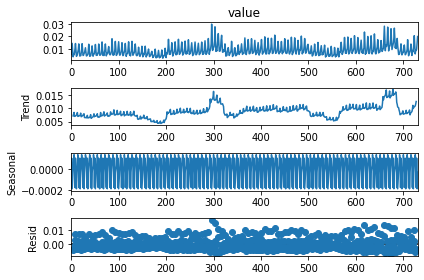

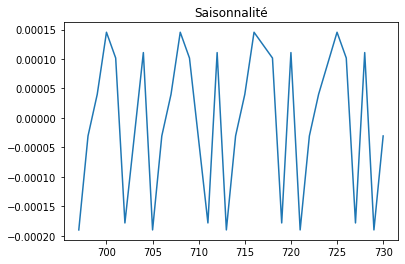

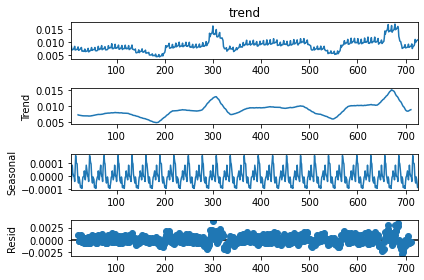

On décompose la série en tendance + saisonnalité. Les étés et Noël apparaissent.

from statsmodels.tsa.seasonal import seasonal_decompose

res = seasonal_decompose(df_nosunday.value, freq=7)

res.plot();

<ipython-input-13-a9c8eeeaae9a>:2: FutureWarning: the 'freq'' keyword is deprecated, use 'period' instead.

res = seasonal_decompose(df_nosunday.value, freq=7)

plt.plot(res.seasonal[-30:])

plt.title("Saisonnalité");

cor = acf(res.trend[5:-5]);

plt.plot(cor);

C:Python395_x64libsite-packagesstatsmodelstsastattools.py:657: FutureWarning: The default number of lags is changing from 40 tomin(int(10 * np.log10(nobs)), nobs - 1) after 0.12is released. Set the number of lags to an integer to silence this warning. warnings.warn( C:Python395_x64libsite-packagesstatsmodelstsastattools.py:667: FutureWarning: fft=True will become the default after the release of the 0.12 release of statsmodels. To suppress this warning, explicitly set fft=False. warnings.warn(

On cherche maintenant la saisonnalité de la série débarrassée de sa tendance herbdomadaire. On retrouve la saisonnalité mensuelle.

res_year = seasonal_decompose(res.trend[5:-5], freq=25)

res_year.plot();

<ipython-input-16-285cbf1eb085>:1: FutureWarning: the 'freq'' keyword is deprecated, use 'period' instead.

res_year = seasonal_decompose(res.trend[5:-5], freq=25)

Test de stationnarité#

Le test KPSS permet de tester la stationnarité d’une série.

from statsmodels.tsa.stattools import kpss

kpss(res.trend[5:-5])

C:Python395_x64libsite-packagesstatsmodelstsastattools.py:1875: FutureWarning: The behavior of using nlags=None will change in release 0.13.Currently nlags=None is the same as nlags="legacy", and so a sample-size lag length is used. After the next release, the default will change to be the same as nlags="auto" which uses an automatic lag length selection method. To silence this warning, either use "auto" or "legacy" warnings.warn(msg, FutureWarning) C:Python395_x64libsite-packagesstatsmodelstsastattools.py:1906: InterpolationWarning: The test statistic is outside of the range of p-values available in the look-up table. The actual p-value is smaller than the p-value returned. warnings.warn(

(0.980161988153884,

0.01,

19,

{'10%': 0.347, '5%': 0.463, '2.5%': 0.574, '1%': 0.739})

Comme ce n’est pas toujours facile à interpréter, on simule une variable aléatoire gaussienne donc sans tendance.

from numpy.random import randn

bruit = randn(1000)

kpss(bruit)

(0.4813396167770415,

0.04586945568084651,

22,

{'10%': 0.347, '5%': 0.463, '2.5%': 0.574, '1%': 0.739})

Et puis une série avec une tendance forte.

from numpy.random import randn

from numpy import arange

bruit = randn(1000) * 100 + arange(1000) / 10

kpss(bruit)

C:Python395_x64libsite-packagesstatsmodelstsastattools.py:1906: InterpolationWarning: The test statistic is outside of the range of p-values available in the look-up table. The actual p-value is smaller than the p-value returned. warnings.warn(

(2.9761535894770517,

0.01,

22,

{'10%': 0.347, '5%': 0.463, '2.5%': 0.574, '1%': 0.739})

Une valeur forte indique une tendance et la série en a clairement une.

Prédiction#

Les modèles AR, ARMA, ARIMA se concentrent sur une série à une dimension. En machine learning, il y a la série et plein d’autres informations. On construit une matrice avec des séries décalées.

from statsmodels.tsa.tsatools import lagmat

lag = 8

X = lagmat(df_nosunday["value"], lag)

lagged = df_nosunday.copy()

for c in range(1,lag+1):

lagged["lag%d" % c] = X[:, c-1]

lagged.tail()

| date | value | notrend | trend | weekday | lag1 | lag2 | lag3 | lag4 | lag5 | lag6 | lag7 | lag8 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 726 | 2022-02-08 18:54:23.461489 | 0.008707 | -0.000466 | 0.009173 | 1 | 0.005806 | 0.020552 | 0.013143 | 0.009727 | 0.007346 | 0.008504 | 0.004580 | 0.013786 |

| 727 | 2022-02-09 18:54:23.461489 | 0.008582 | -0.000596 | 0.009178 | 2 | 0.008707 | 0.005806 | 0.020552 | 0.013143 | 0.009727 | 0.007346 | 0.008504 | 0.004580 |

| 728 | 2022-02-10 18:54:23.461489 | 0.009646 | 0.000464 | 0.009182 | 3 | 0.008582 | 0.008707 | 0.005806 | 0.020552 | 0.013143 | 0.009727 | 0.007346 | 0.008504 |

| 729 | 2022-02-11 18:54:23.461489 | 0.014557 | 0.005370 | 0.009187 | 4 | 0.009646 | 0.008582 | 0.008707 | 0.005806 | 0.020552 | 0.013143 | 0.009727 | 0.007346 |

| 730 | 2022-02-12 18:54:23.461489 | 0.019851 | 0.010660 | 0.009191 | 5 | 0.014557 | 0.009646 | 0.008582 | 0.008707 | 0.005806 | 0.020552 | 0.013143 | 0.009727 |

On ajoute ou on réécrit le jour de la semaine qu’on utilise comme variable supplémentaire.

lagged["weekday"] = lagged.date.dt.weekday

X = lagged.drop(["date", "value", "notrend", "trend"], axis=1)

Y = lagged["value"]

X.shape, Y.shape

((627, 9), (627,))

from numpy import corrcoef

corrcoef(X)

array([[1. , 0.99999912, 0.99999792, ..., 0.99999049, 0.99999476,

0.99999663],

[0.99999912, 1. , 0.99999936, ..., 0.99998874, 0.99999358,

0.99999672],

[0.99999792, 0.99999936, 1. , ..., 0.99998653, 0.99999169,

0.99999553],

...,

[0.99999049, 0.99998874, 0.99998653, ..., 1. , 0.9999852 ,

0.99998403],

[0.99999476, 0.99999358, 0.99999169, ..., 0.9999852 , 1. ,

0.99999084],

[0.99999663, 0.99999672, 0.99999553, ..., 0.99998403, 0.99999084,

1. ]])

Etrange autant de grandes valeurs, cela veut dire que la tendance est

trop forte pour calculer des corrélations, il vaudrait mieux tout

recommencer avec la série . Bref,

passons…

X.columns

Index(['weekday', 'lag1', 'lag2', 'lag3', 'lag4', 'lag5', 'lag6', 'lag7',

'lag8'],

dtype='object')

Une régression linéaire car les modèles linéaires sont toujours de bonnes baseline et pour connaître le modèle simulé, on ne fera pas beaucoup mieux.

from sklearn.linear_model import LinearRegression

clr = LinearRegression()

clr.fit(X, Y)

LinearRegression()

from sklearn.metrics import r2_score

r2_score(Y, clr.predict(X))

0.8789132280236231

clr.coef_

array([ 0.0016414 , 0.34593324, 0.26436686, 0.08632379, 0.01356802,

-0.03755237, 0.40831821, -0.12106444, -0.07772163])

On retrouve la saisonnalité, et

sont de

mèches.

for i in range(1, X.shape[1]):

print("X(t-%d)" % (i), r2_score(Y, X.iloc[:, i]))

X(t-1) -0.48934404097448847

X(t-2) -1.0143639444424148

X(t-3) -1.228186547024929

X(t-4) -1.0378510803717922

X(t-5) -0.5496246593771723

X(t-6) 0.7876799792178883

X(t-7) -0.5843479675288277

X(t-8) -1.1145521360143462

Auparavant (l’année dernière en fait), je construisais deux bases, apprentissage et tests, comme ceci :

n = X.shape[0]

X_train = X.iloc[:n * 2//3]

X_test = X.iloc[n * 2//3:]

Y_train = Y[:n * 2//3]

Y_test = Y[n * 2//3:]

Et puis scikit-learn est arrivée avec TimeSeriesSplit.

from sklearn.model_selection import TimeSeriesSplit

tscv = TimeSeriesSplit(n_splits=5)

for train_index, test_index in tscv.split(lagged):

data_train, data_test = lagged.iloc[train_index, :], lagged.iloc[test_index, :]

print("TRAIN:", data_train.shape, "TEST:", data_test.shape)

TRAIN: (107, 13) TEST: (104, 13)

TRAIN: (211, 13) TEST: (104, 13)

TRAIN: (315, 13) TEST: (104, 13)

TRAIN: (419, 13) TEST: (104, 13)

TRAIN: (523, 13) TEST: (104, 13)

Et on calé une forêt aléatoire…

import warnings

from sklearn.ensemble import RandomForestRegressor

clr = RandomForestRegressor()

def train_test(clr, train_index, test_index):

data_train = lagged.iloc[train_index, :]

data_test = lagged.iloc[test_index, :]

clr.fit(data_train.drop(["value", "date", "notrend", "trend"],

axis=1),

data_train.value)

r2 = r2_score(data_test.value,

clr.predict(data_test.drop(["value", "date", "notrend",

"trend"], axis=1).values))

return r2

warnings.simplefilter("ignore")

last_test_index = None

for train_index, test_index in tscv.split(lagged):

r2 = train_test(clr, train_index, test_index)

if last_test_index is not None:

r2_prime = train_test(clr, last_test_index, test_index)

print(r2, r2_prime)

else:

print(r2)

last_test_index = test_index

0.8074141052461008

0.740621811076557 0.6980805419883442

0.9382338424157237 0.938776218559058

0.8763703927657517 0.7726502689480175

0.6429356690810921 0.6615420727005181

2 ans coupé en 5, soit tous les 5 mois, ça veut dire que ce découpage inclut parfois Noël, parfois l’été et que les performances y seront très sensibles.

from sklearn.metrics import r2_score

r2 = r2_score(data_test.value,

clr.predict(data_test.drop(["value", "date", "notrend",

"trend"], axis=1).values))

r2

0.6615420727005181

On compare avec le avec le même

obtenu en

utilisant

,

, …

comme

prédiction.

for i in range(1, 9):

print(i, ":", r2_score(data_test.value, data_test["lag%d" % i]))

1 : -0.5322711277436745

2 : -1.0330346880701402

3 : -1.2289501631550408

4 : -1.0866973927813812

5 : -0.6533003518045957

6 : 0.683558097073121

7 : -0.6863597347439538

8 : -1.2181386641893033

lagged[:5]

| date | value | notrend | trend | weekday | lag1 | lag2 | lag3 | lag4 | lag5 | lag6 | lag7 | lag8 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2020-02-13 18:54:23.461489 | 0.005357 | -0.000507 | 0.005864 | 3 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 1 | 2020-02-14 18:54:23.461489 | 0.009562 | 0.003694 | 0.005868 | 4 | 0.005357 | 0.000000 | 0.000000 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2 | 2020-02-15 18:54:23.461489 | 0.014353 | 0.008481 | 0.005873 | 5 | 0.009562 | 0.005357 | 0.000000 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 4 | 2020-02-17 18:54:23.461489 | 0.003475 | -0.002407 | 0.005882 | 0 | 0.014353 | 0.009562 | 0.005357 | 0.000000 | 0.0 | 0.0 | 0.0 | 0.0 |

| 5 | 2020-02-18 18:54:23.461489 | 0.005454 | -0.000432 | 0.005886 | 1 | 0.003475 | 0.014353 | 0.009562 | 0.005357 | 0.0 | 0.0 | 0.0 | 0.0 |

En fait le jour de la semaine est une variable catégorielle, on crée une colonne par jour.

from sklearn.compose import ColumnTransformer

from sklearn.preprocessing import OneHotEncoder

cols = ['lag1', 'lag2', 'lag3',

'lag4', 'lag5', 'lag6', 'lag7', 'lag8']

ct = ColumnTransformer(

[('pass', "passthrough", cols),

("dummies", OneHotEncoder(), ["weekday"])])

pred = ct.fit(lagged).transform(lagged[:5])

pred

array([[0. , 0. , 0. , 0. , 0. ,

0. , 0. , 0. , 0. , 0. ,

0. , 1. , 0. , 0. ],

[0.0053571 , 0. , 0. , 0. , 0. ,

0. , 0. , 0. , 0. , 0. ,

0. , 0. , 1. , 0. ],

[0.00956219, 0.0053571 , 0. , 0. , 0. ,

0. , 0. , 0. , 0. , 0. ,

0. , 0. , 0. , 1. ],

[0.01435337, 0.00956219, 0.0053571 , 0. , 0. ,

0. , 0. , 0. , 1. , 0. ,

0. , 0. , 0. , 0. ],

[0.00347454, 0.01435337, 0.00956219, 0.0053571 , 0. ,

0. , 0. , 0. , 0. , 1. ,

0. , 0. , 0. , 0. ]])

On met tout dans un pipeline parce que c’est plus joli, plus pratique aussi.

from sklearn.pipeline import make_pipeline

from sklearn.decomposition import PCA, TruncatedSVD

cols = ['lag1', 'lag2', 'lag3',

'lag4', 'lag5', 'lag6', 'lag7', 'lag8']

model = make_pipeline(

make_pipeline(

ColumnTransformer(

[('pass', "passthrough", cols),

("dummies", make_pipeline(OneHotEncoder(),

TruncatedSVD(n_components=2)), ["weekday"])]),

LinearRegression()))

model.fit(lagged, lagged["value"])

Pipeline(steps=[('pipeline',

Pipeline(steps=[('columntransformer',

ColumnTransformer(transformers=[('pass',

'passthrough',

['lag1',

'lag2',

'lag3',

'lag4',

'lag5',

'lag6',

'lag7',

'lag8']),

('dummies',

Pipeline(steps=[('onehotencoder',

OneHotEncoder()),

('truncatedsvd',

TruncatedSVD())]),

['weekday'])])),

('linearregression', LinearRegression())]))])

C’est plus facile à voir visuellement.

from mlinsights.plotting import pipeline2dot

dot = pipeline2dot(model, lagged)

from jyquickhelper import RenderJsDot

RenderJsDot(dot)

r2_score(lagged['value'], model.predict(lagged))

0.8800492232136333

Templating#

Complètement hors sujet mais utile.

from jinja2 import Template

template = Template('Hello {{ name }}!')

template.render(name='John Doe')

'Hello John Doe!'

template = Template("""

{{ name }}

{{ "-" * len(name) }}

Possède :

{% for i in range(len(meubles)) %}

- {{meubles[i]}}{% endfor %}

""")

meubles = ['table', "tabouret"]

print(template.render(name='John Doe Doe', len=len,

meubles=meubles))

John Doe Doe

------------

Possède :

- table

- tabouret